The Brazilian government detailed its proposal for a multibillion-dollar global fund aimed at preserving tropical forests. This initiative seeks to financially reward countries for the conservation of these vital biomes, reducing CO2 emissions and protecting biodiversity.

The Brazilian government estimates the fund could gather approximately $125 billion (700 billion reais), although this is not a firm target.

Initially presented by Brazil at COP28 last December, the idea was met with skepticism due to a lack of details. The proposal has since been refined into a 34-page document presented on Friday to a select group of international authorities that were in Rio de Janeiro for a G20 finance ministers meeting.

Reset had access to the document.

Finance Minister Fernando Haddad and Environment Minister Marina Silva led the presentation, accompanied by World Bank president Ajay Banga and officials from potential funding countries, including the United States, Norway, France, the United Kingdom, Germany, Singapore and the United Arab Emirates. Representatives from Colombia, eligible to receive funds, were also present.

An Innovative Funding Mechanism

The Tropical Forest Finance Facility (TFFF) would borrow funds from rich countries, multilateral development banks and institutional investors at interest rates corresponding to their respective credit raitings. These funds would then be invested in higher-yield portfolios, with the returns used to compensate countries for preserving their tropical forests.

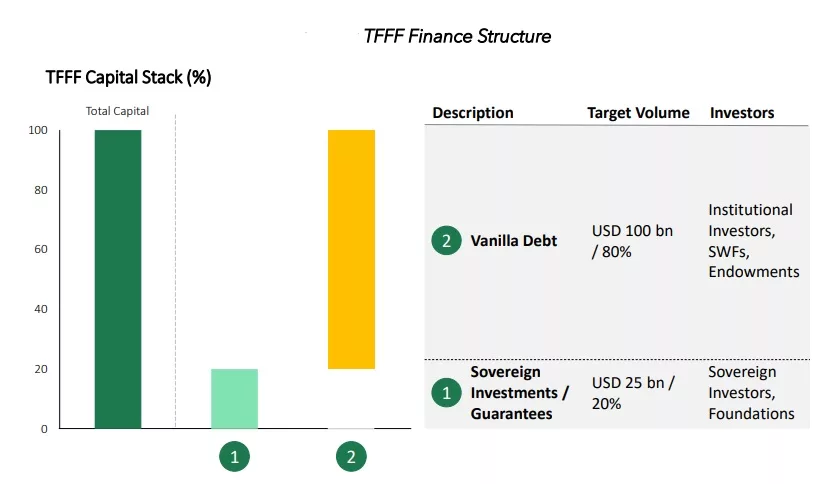

The TFFF plans to source about 20% of its capital through long-term loans from developed countries, providing returns consistent with their investment grades. Philanthropic entities could also be part of this 20% through donations.

The remaining 80% of the capital would be raised by issuing debt securities to institutional and retail investors. These securities are expected to achieve high ratings, reducing funding costs.

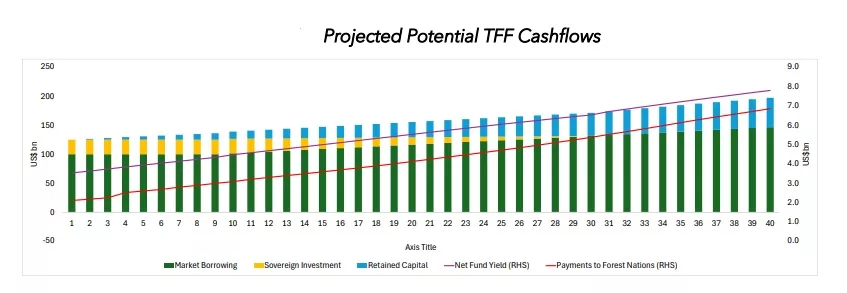

Once raised, the funds would be invested in a portfolio of bonds with an average “BB+” rating, offering higher returns. The yield from the difference between the funding cost and the investment return would be used to pay countries for forest conservation.

Payments to these countries would be made annually, contingent upon proof that there was no forested area loss during that period.

Fund Impact and Structure

While no specific target is set, a simulation based on a $125 billion fund suggests a portfolio yield of 7.5% per annum and a funding cost of around 4.4% per annum, resulting in a 3.1% interest rate spread, generating $3.9 billion in annual returns.

“With approximately 1 billion hectares of eligible forests, this would equate to a payment of $4 per hectare,” the document states.

If successful, the fund would represent a significant increase in climate finance for Global South countries, providing strong financial incentives for forest conservation and creating demand for ‘green’ debt securities, channeling resources into environmentally beneficial projects.

The fund’s priority would be to purchase green, blue (water-related projects), and sustainable bonds from developing countries. It could also invest in traditional sovereign debt of developing nations and high-yield bonds from developed countries.

Eligibility and Monitoring

Of the 79 countries with tropical forests, approximately 12 wealthy countries are excluded from the proposal. Eligibility for the remaining countries would be based on low deforestation and degradation rates compared to the previous year, with an initial maximum deforestation rate of 0.5% per year.

Once enrolled, the deforestation rate must not exceed a certain annual threshold, suggested at 0.1%.

One of TFFF’s key innovations is its monitoring mechanisms, utilizing satellite imagery with publicly available criteria and data, focusing on tree cover area to avoid complex and costly carbon measurement methods. The proposal states that the fund will complement, not compete with, carbon credit projects.

The mechanism would also offer an attractive alternative to current climate donations from rich nations, as it involves loans returning to their Treasuries after 30 to 40 years. Currently, donations entail political costs as they are included in national budgets and require approval.

To participate, these countries can issue sovereign bonds to raise funds and invest them in the TFFF at the same rate, with no budgetary impact.

While aligned with the Paris Agreement goals, the fund does not fall under UN rules. However, there is still a lot of work to be done.

As brazilian Finance minister Fernando Haddad remarked at the meeting’s conclusion, the proposal presented on Friday outlines the fund’s architecture, and now begins the engineering phase.

Brazil will seek input from interested countries, aiming to present a more detailed design at COP29 in Azerbaijan, with a formal launch targeted for COP30 in Belém.